For the customer, the deposit slip or receipt can prove the bank properly processed the funds. It’s also a checking mechanism that the correct account was paid. Although a deposit slip proves the deposit was made, a receipt will only show the amount being deposited, not the breakdown of checks or monies. Deposit slips are a small form of paper that a bank or credit union customer fills out when depositing funds into their account.

More Space Needed

All your cash goes in one line on the deposit slip, and each individual check gets its own line. Generally, Bank Five Nine makes funds from your deposit available to you on the first business day after the day we receive your deposit. Electronic direct deposits will be available on the day we receive the deposit. Once the funds are available, you may https://www.bookstime.com/ withdraw the funds in cash and we will use the funds to paychecks you have written. Exceptions for this occur during weekends (Saturdays and Sundays), Federal Holidays, and during other delays. Another great way to know how much you can spend is to check your available balance or ask a Bank Five Nine teller when the funds will become available.

Bankrate logo

- You typically don’t need to fill out a deposit slip when depositing a cashier’s check.

- If depositing more than one check, there’s space on the back of the deposit slip to avoid having to fill in another.

- Foreign banks use IBAN, which is short for International Bank Account Number.

- On the other hand, checks are a method of payment between two parties.

- A deposit slip allows you to deposit cash and checks into your bank account or someone else’s account.

- The bank deposit slip has been around as long as there have been banks.

- You may be able to list more checks on the back of a deposit slip if you run out of slots in the front.

Someone could, for example, use your bank routing number and checking account number to order fraudulent checks. Or they may be able to initiate a fraudulent ACH withdrawal from your account. If your checking account comes with paper checks, they’re the first place where is the account number on a deposit slip to search for your routing number. You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website.

Listing Each Individual Check Separately

Typically, deposit slips include fields to enter information such as your name, account number, the numbers of any deposited checks, deposit amount, and transaction date. Deposit slips are often a basic part of banking, but you may not know how to use them in this era of online financial accounts. If your bank or credit union requires one, a deposit slip is easy to fill out. It is a document that requires key personal and financial information such as your name, account number, and deposit amount. Deposit slips can be valuable for tracking transactions and ensuring your money is directed to your bank account correctly.

Generally, when you order a set of checks from your bank, a pad of deposit slips will be included in the checkbook. It’s important to have your deposit slip filled out before asking a teller to deposit your funds. The account number listed on a check for your checking account is used to identify the unique bank account that the money is coming from. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

- A deposit slip states the date, the name of the depositor, the depositor’s account number, and the amounts being deposited.

- If you also have a $50 check and a $35 check, you’ll list these in their own lines; that is, on two separate lines.

- You may be able to find this number right on the homepage of the bank’s website.

- Read our reviews on Quickbooks Checks and Deposit Slips and VistaPrint Checks and Deposit Slips for two great places to order deposit slips.

- Learn the correct way to fill out a deposit slip to ensure your trip to the bank is quick, easy and your money is accurately deposited into your account.

- Always endorse the check, and you may need to write an extra note below the signature if the check isn’t being directly handed to a bank teller.

- It’s more common today to find deposits slips in the bank at the teller’s counter or perhaps in the reception area.

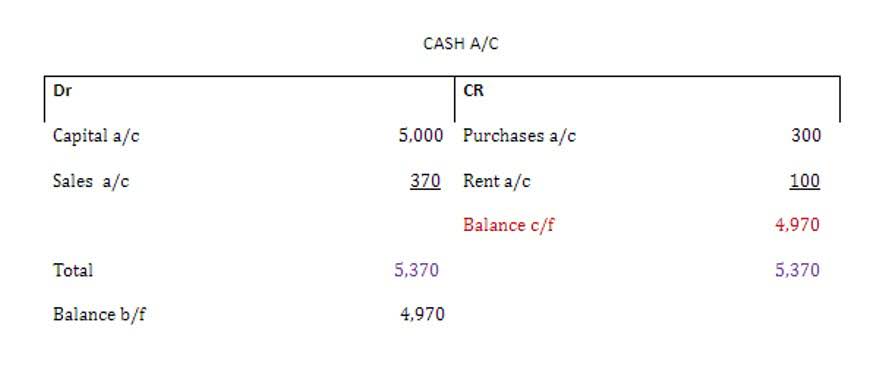

A checking deposit slip is a small written form that is used to place funds into your account. It indicates the deposit date, name and account number of the depositor, and the monetary amount to be deposited in the form of checks, and cash. It’s filled out much like a regular check, but it includes various deposit kinds. Read on to find out how to properly fill out a checking deposit slip. A check’s last set of digits represents the check number (labeled “3” in the image above).

But unlike mobile deposits that only require a smartphone camera lens to capture the check’s image, online check deposits require a scanner. Checks are a paper form of payment that can be deposited into a bank account in several ways, including through traditional and newer, digital methods. Here are five ways to deposit a check and the steps necessary for each. Another possible way to find your bank account number online is by downloading a copy of your electronic or paper statement.

Rebecca Lake is a certified educator in personal finance (CEPF) and a banking expert. She’s been writing about personal finance since 2014, and her work has appeared in numerous publications online. Beyond banking, her expertise covers credit and debt, student loans, investing, home buying, insurance and small business. The bank keeps the original deposit slip and typically gives you a receipt from the transaction.

- When you need to deposit your paycheck or the check your grandmother sent you for your birthday, you have to fill out a form and present it to your bank.

- We do not include the universe of companies or financial offers that may be available to you.

- Once the funds are available, you may withdraw the funds in cash and we will use the funds to paychecks you have written.

- Bankrate.com is an independent, advertising-supported publisher and comparison service.

- We recommend that you review the privacy policy of the site you are entering.

- These numbers identify your bank and your individual account, respectively.